Category Archives for "Blog"

Gorgeous brick 1 1/2 story waiting for your family to call home in Northhampton, next to St Louis Hills. Walking distance to Hampton Village. Some newer lighting and freshly painted. Newer insulated windows with plantation blinds in living room & dining room. Warm & inviting fireplace in the living room with beautiful architectural crown molding. Updated kitchen with ceramic floors. Updated bath with an extra-large vanity. 2 bedrooms on the main level and 2 bedrooms on the second floor with a walk-in cedar closet in the back bedroom. Partially finished lower level with a family room/rec room with a toilet. Then there’s a great fenced back yard with a brick patio & lots of perennials for each season. There is also an oversized 2 car garage with a newer garage door. All this just blocks from Ted Drewes. Asking Price of $169,900 ~ Call Kathi at 314-276-0227 for more info.

Stunning!! Spacious Updated 2 story Farmhouse, on secluded 8+ acres of park like land, in Pevely, in the Herculaneum school district. Beautiful granite countertops including a huge island with an apron front farmhouse sink. All new stainless appliances with a stainless hood vent as well as a new subway tile backsplash. Did I mention the amazing walk-in pantry! Lots of wows throughout. Large breakfast/dining area with windows on 3 sides. Spacious 645 sq ft great room with stone fireplace hardwood floors, and crown molding. New baseboard & crown molding, new lighting throughout. Updated full bath & half bath. Decorative tin ceilings. Master bedroom was enlarged with a his & hers walk-in closet with sliding barn door. Luxury master bath with shower & jetted tub. Main floor laundry, new carpet & laminate flooring in the back of the house. New roof last year, zoned HVAC. Then there is the mother-in-law suite upstairs with a kitchen, bath, living room and 2 bedrooms all recently updated. On the outside you have a wrap around porch, park like yard, lots of parking including a driveway with new retaining wall & electric. Also, it is on public water & sewer very recently converted. Open House on Sept 29, 2018 1-3 pm. Asking $347,500.

Don’t wait until you’re ready to move to start preparing financially to buy a home.

If you’re like the vast majority of home buyers, you will choose to finance your purchase with a mortgage loan. By preparing in advance, you can avoid the common delays and roadblocks many buyers face when applying for a mortgage.

The requirements to secure a mortgage may seem overwhelming, especially if you’re a first-time buyer. But we’ve outlined three simple steps to get you started on your path to homeownership.

Even if you’re a current homeowner, it’s a good idea to prepare in advance so you don’t encounter any surprises along the way. Lending requirements have become more rigorous in recent years, and changes to your credit history, debt levels, job type and other factors could impact your chances of approval.

It’s never too early to start preparing to buy a home. Follow these three steps to begin laying the foundation for your future home purchase today!

STEP 1: CHECK YOUR CREDIT SCORE

Your credit score is one of the first things a lender will check to see if you qualify for a loan. It’s a good idea to review your credit report and score yourself before you’re ready to apply for a mortgage. If you have a low score, you will need time to raise it. And sometimes fraudulent activity or erroneous information will appear on your report, which can take months to correct.

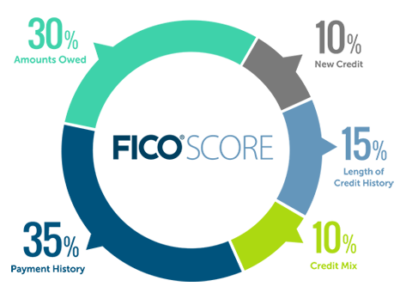

The credit score most lenders use is your FICO score, a weighted score developed by the Fair Isaac Corporation that takes into account your payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).1

Source: myFico.com

Base FICO scores range from 300 to 850. A higher FICO score will help you qualify for a lower mortgage interest rate, which will save you money.2

By federal law, you are entitled to one free copy of your credit report every 12 months from each of the three major credit bureaus (Equifax, Experian and Transunion). Request your free credit report at https://www.annualcreditreport.com.

Minimum Score Requirements

To qualify for the lowest interest rates available, you will usually need a FICO score of 760 or higher. Most lenders require a score of at least 620 to qualify for a conventional mortgage.3

If your FICO score is less than 620, you may be able to qualify for a non-conventional mortgage. However, you should expect to pay higher interest rates and fees. For example, you may be able to secure an FHA loan (one issued by a private lender but insured by the Federal Housing Administration) with a credit score as low as 580 if you can make a 3.5 percent down payment. And FHA loans are available to applicants with credit scores as low as 500 with a 10 percent down payment.4

Increase Your Credit Score

There’s no quick fix for a low credit score, but the following steps will help you increase it over time.5

At 35 percent, your payment history accounts for the largest portion of your credit score. Therefore, it’s crucial to get caught up on any late payments and make all of your future payments on time.

If you have trouble remembering to pay your bills on time, set up payment reminders through your online banking platform, a free money management tool like Mint, or an app like BillMinder.

New accounts will lower your average account age, which could negatively impact your length of credit history. Also, each time you apply for credit, it can result in a small decrease in your credit score.

The exception to this rule? If you don’t have any credit cards—or any credit accounts at all—you should open an account to establish a credit history. Just be sure to use it responsibly and pay it off in full each month.

If you need to shop for a new credit account, for example, a car loan, be sure to complete your loan applications within a short period of time. FICO attempts to distinguish between a search for a single loan and applications to open several new lines of credit by the window of time during which inquiries occur.

When you pay off your credit cards and other revolving credit, you lower your amounts owed, or credit utilization ratio (ratio of account balances to credit limits). Some experts recommend starting with your highest-interest debt and paying it off first. Others suggest paying off your lowest balance first and then rolling that payment into your next-lowest balance to create momentum.

Whichever method you choose, the first step is to make a list of all of your credit card balances and then start tackling them one by one. Make the minimum payments on all of your cards except one. Pay as much as possible on that card until it’s paid in full, then cross it off your list and move on to the next card.

| Debt | Interest Rate | Total Payoff | Minimum Payment |

| Credit Card 1 | 12.5% | $460 | $18.40 |

| Credit Card 2 | 18.9% | $1,012 | $40.48 |

| Credit Card 3 | 3.11% | $6,300 | $252 |

Closing an old account will not remove it from your credit report. In fact, it can hurt your score, as it can raise your credit utilization ratio—since you’ll have less available credit—and decrease your average length of credit history.

Similarly, paying off a collection account will not remove it from your report. It remains on your credit report for seven years, however, the negative impact on your score will decrease over time.

Mistakes or fraudulent activity can negatively impact your credit score. That’s why it’s a good idea to check your credit report at least once per year. The Federal Trade Commission has instructions on their website for disputing errors on your report.

While it may seem like a lot of effort to raise your credit score, your hard work will pay off in the long run. Not only will it help you qualify for a mortgage, a high credit score can help you secure a lower interest rate on car loans and credit cards, as well. You may even qualify for lower rates on insurance premiums.6

STEP 2: SAVE UP FOR A DOWN PAYMENT AND CLOSING COSTS

The next step in preparing for your home purchase is to save up for a down payment and closing costs.

Down Payment

When you purchase a home, you typically pay for a portion of it in cash (down payment) and take out a loan to cover the remaining balance (mortgage).

Many first-time buyers wonder: How much do I need to save for a down payment? The answer is … it depends.

Generally speaking, the higher your down payment, the more money you will save on interest and fees. For example, you will qualify for a lower interest rate and avoid paying for mortgage insurance if your down payment is at least 20 percent of the property’s purchase price. But what if you can’t afford to put down 20 percent?

On a conventional loan, you will be required to purchase private mortgage insurance (PMI) if your down payment is less than 20 percent. PMI is insurance that compensates your lender if you default on your loan.7

PMI will cost you between 0.3 to 1.5 percent of the overall mortgage amount each year.8 So, on a $100,000 loan, you can expect to pay between $300 and $1500 per year for PMI until your mortgage balance falls below 80 percent of the appraised value.9 For a conventional mortgage with PMI, most lenders will accept a minimum down payment of five percent of the purchase price.7

If a five-percent down payment is still too high, an FHA-insured loan may be an option for you. Because they are guaranteed by the Federal Housing Administration, FHA loans only require a 3.5 percent down payment if your credit score is 580 or higher.7

The downside of getting an FHA loan? You’ll be required to pay an upfront mortgage insurance premium (MIP) of 1.75 percent of the total loan amount, as well as an annual MIP of between 0.80 and 1.05 percent of your loan balance on a 30-year note. There are also certain limitations on the types of loans and properties that qualify.10

There are a variety of other government-sponsored programs created to assist home buyers, as well. For example, veterans and current members of the Armed Forces may qualify for a VA-backed loan requiring a $0 down payment.7 Consult a mortgage lender about what options are available to you.

| TYPE | MINIMUM DOWN | ADDITIONAL FEES |

| Conventional Loan | 20% | Qualify for the best rates and no mortgage insurance required |

| Conventional Loan | 5% | Must purchase private mortgage insurance costing 0.3 – 1.5% of mortgage annually |

| FHA Loan | 3.5% | Upfront mortgage insurance premium of 1.75% of loan amount and annual fee of 0.8 – 1.05% |

Current Homeowners

If you’re a current homeowner, you may have equity in your home that you can use toward your down payment on a new home. We can help you estimate your expected return after you sell your current home and pay back your existing mortgage. Contact us for a free evaluation!

Closing Costs

Closing costs should also be factored into your savings plan. These may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys and other fees associated with the purchase of your home. Closing costs vary but typically range between two to five percent of the purchase price.11

If you don’t have the funds to pay these outright at closing, you can often add them to your mortgage balance and pay them over time. However, this means you’ll have a higher monthly payment and pay more over the long term because you’ll pay interest on the fees.

STEP 3: ESTIMATE YOUR HOME PURCHASING POWER

Once you have the required credit score, savings for a down payment and a list of all your outstanding debt obligations via your credit report, you can assess whether you are ready and able to purchase a home.

It’s important to have a sense of how much you can reasonably afford—and how much you’ll be able to borrow—to see if homeownership is within reach.

Your debt-to-income (DTI) ratio is one of the main factors mortgage companies use to determine how much they are willing to lend you, and it can help you gauge whether or not your home purchasing goals are realistic given your current financial situation.

Your DTI ratio is essentially a comparison of your housing expenses and other debt versus your income. There are two different DTI ratios that lenders consider:

Front-End Ratio

Also called the housing ratio, this is the percentage of your income that would go toward housing expenses each month, including your mortgage payment, private mortgage insurance, property taxes, homeowner’s insurance and association dues.12

To calculate your front-end DTI ratio, a lender will add up your expected housing expenses and divide it by your gross monthly income (income before taxes). The maximum front-end DTI ratio for most mortgages is 28 percent. For an FHA-backed loan, this ratio must not exceed 31 percent.13

Back-End Ratio

The back-end ratio takes into account all of your monthly debt obligations: your expected housing expenses PLUS credit card bills, car payments, child support or alimony, student loans and any other debt that shows up on your credit report.12

To calculate your back-end ratio, a lender will tabulate your expected housing expenses and other monthly debt payments and divide it by your gross monthly income (income before taxes). The maximum back-end DTI ratio for most mortgages is 36 percent. For an FHA-backed loan, this ratio must not exceed 41 percent.13

Home Affordability Calculator

To get a sense of how much home you can afford, visit the National Association of Realtors’ free Home Affordability Calculator at https://www.realtor.com/mortgage/tools/affordability-calculator.

This handy tool will help you determine your home purchasing power depending on your location, annual income, monthly debt and down payment. It also offers a monthly mortgage breakdown that projects what you would pay each month in principal and interest, property taxes, and home insurance.

The Home Affordability Calculator defaults to a back-end DTI ratio of 36 percent. If the monthly cost estimate at that ratio is significantly higher than what you’re currently paying for housing, you need to consider whether or not you can make up the difference each month in your budget.

If not, you may want to lower your target purchase price to a more conservative DTI ratio. The tool enables you to scroll through higher and lower price points to see the impact on your monthly payments so you can identify your ideal price point.

(Note: This tool only provides an estimate of your purchasing power. You will need to secure pre-approval from a mortgage lender to know your true mortgage approval amount and monthly payment projections.)

Can I Afford to Buy My Dream Home?

Once you have a sense of your purchasing power, it’s time to find out which neighborhoods and types of homes you can afford. The best way to determine this is to contact a licensed real estate agent. We help homeowners like you every day and can send you a comprehensive list of homes within your budget that meet your specific needs.

If there are homes within your price range and target neighborhoods that meet your criteria—congratulations! It’s time to begin your home search.

If not, you may need to continue saving up for a larger down payment … or adjust your search parameters to find homes that do fit within your budget. We can help you determine the right course for you.

START LAYING YOUR FOUNDATION TODAY

It’s never too early to start preparing financially for a home purchase. These three steps will set you on the path toward homeownership … and a secure financial future!

And if you are ready to buy now but don’t have a perfect credit score or a big down payment, don’t get discouraged. There are resources and options available that might make it possible for you to buy a home sooner than you think. We can help.

Want to find out if you’re ready to buy a house? Give us a call! We’ll help you review your options, connect you with one of our trusted mortgage lenders, and help you determine the ideal time to begin your new home search.

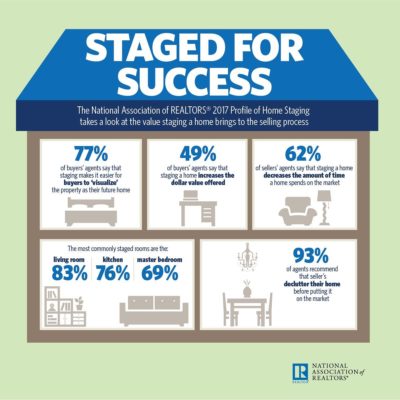

According to the National Association of Realtors, staging a home prior to listing it can result in a faster and more profitable sale.1 In fact, the Real Estate Staging Association estimates that professionally staged properties spend 73 percent less time on the market, receive more foot traffic, and typically sell for more money.2

Source: National Association of Realtors

Following are 10 tips you can use to get your home “show ready” prior to hitting the market. These easy and cost-effective ideas will help your house look its best—and help buyers visualize themselves living there. Even if you’re not currently in the market to sell, you can use these tactics to breathe new life into your existing home decor.

To get a plan customized for your particular property, give us a call to schedule a free consultation. We’d be happy to share our insider knowledge of the buyer preferences in your neighborhood … so you’ll know where to focus your time, money and energy to maximize your results.

Decluttering is typically the first thing we tell clients to do to prepare their home for sale. And according to the National Association of Realtors, a whopping 93 percent of agents agree.1 Decluttering is the act of removing excess “stuff” from your home to make it appear clean and spacious.

Overflowing closets and cluttered countertops can make your house feel small and cramped. In contrast, sparsely-filled closets and clear countertops will make your home appear larger and assure buyers that there will be plenty of room to store their belongings.

Don’t neglect drawers, cupboards and even your refrigerator in your decluttering efforts. Serious buyers will check out every nook and cranny of your home, so pack up anything you don’t use on a daily basis and store it off site. The same goes for jewelry, sensitive documents, prescription medication, firearms and other items of value. Store them in a locked safe or storage unit before opening your property to buyers.

Make sure any items that remain are clean, tidy and well organized. The good news is, when it comes time to move, a large portion of your packing will be done!

From carpets to bathrooms to appliances, having a clean home is a MUST. If you’ve ever checked into a dirty hotel room, you can imagine how buyers can be turned off by a home that hasn’t been thoroughly cleaned.

If you have a large home, or are short on time, you may want to invest in a professional cleaning service. And if you have carpet, we generally recommend you rent a steam cleaner or hire a company to clean your carpets for you.

In addition to cleaning, it’s equally important to neutralize odors in your home that can be off-putting to buyers, especially pet smells and cigarette smoke. If the weather allows, open your windows and let in fresh air. Empty the trash frequently, and especially before a showing. Avoid cooking any strong-smelling food such as fish or heavy spices. You may need to clean (or remove) drapes and upholstery if odors are particularly strong.

Try to keep your home in clean, show-ready condition while it’s on the market. You never know when a potential buyer will want to drop by for a viewing.

Your family photos and personal mementos are often your most treasured possessions. For many of us, they are what make a house a home. However, buyers will have a hard time envisioning themselves living in a place if it feels like YOUR home.

Pack up any items that are personal to you and your family, such as photos, books, children’s artwork, travel souvenirs and religious items. Collectibles and excessive knickknacks can be distracting to buyers. Instead, keep your decor items minimal and generic to appeal to the largest number of buyers.

Along those same lines, bold color choices may not appeal to all buyers. By incorporating a neutral color palette throughout your home, buyers can better visualize the addition of their own furniture and decor, which may contrast with your current color scheme.

But don’t limit yourself to white and beige. Incorporating earth tones and midtone neutrals—like mocha and “greige” (grey-beige)—can add a touch of modern sophistication to your decor.3

One of the quickest and most cost-effective ways to neutralize your home’s decor is with paint. Walls painted in dark, bold or bright colors can turn off buyers. A fresh coat of paint in a neutral color like greige (try Benjamin Moore’s Revere Pewter) or warm white (such as Kelly-Moore’s Rotunda White) offers a clean palette upon which buyers can visualize adding their own personal touches.4

If your sofa is worn, stained or has a bold pattern, consider purchasing a neutral-colored slipcover. Dated or overly busy window coverings should be taken down or replaced. Instead, bring in tasteful pops of color with throw pillows and accessories.

You only get one chance to make a first impression. According to a 2017 report by the National Association of Realtors, 44 percent of home buyers drove by a property after viewing it online but did NOT go inside for a walk-through5 That means if your curb appeal is lacking, buyers may never make it through the door.

Walk around your home and look for any neglected areas that might seem like “red flags” to buyers, such as missing roof shingles or rotted siding. Trim trees and shrubs if needed, and make sure your lawn and flower beds are well maintained. Add some colorful flowers to your front beds and/or flower boxes to brighten up your landscaping.

Make sure the exterior of your home is as clean as the interior. This can often be accomplished with a simple garden hose. But if your siding, walkway, or driveway are stained or dingy, you may want to rent a pressure washer.

Thoroughly wash windows and screens, and remove and store dark solar screens if you have them. Open shutters, curtains and blinds, which will not only make your house look more inviting from the outside, it will brighten the inside.

Consider a fresh coat of paint on your front door, trim and shutters. And small, cosmetic improvements like new house numbers, a colorful wreath and a clean front doormat can have a big impact.6

Kitchens and bathrooms will show better and appear larger if all items are cleared from the countertops, except for one or two decorative pieces.7 You should have already packed up non-essentials during your decluttering process, and the remaining items should be neatly stored in pantries and cupboards.

If your cabinets are dingy or outdated, adding a fresh coat of paint and new hardware is an easy and inexpensive way to make them modern and bright. Consider purchasing new shower curtains, bath mats and towels for the bathrooms and new dish towels for the kitchen.

Before each showing, make sure kitchens and baths are spotless and trash cans are empty and out of sight. To add a comforting aroma, try baking cookies, or in the fall, simmer some cinnamon sticks and cloves in a pot of water before you leave the house. In the spring, try a vase of fresh cut lilacs.7

Buyers often imagine hosting family gatherings in their new home, and the dining room plays a large role in that vision. If your dining room chairs are stained or outdated, you may want to recover them or use slipcovers. In most cases, an imperfect table can be camouflaged with a neutral and stylish tablecloth.

Buyers often imagine hosting family gatherings in their new home, and the dining room plays a large role in that vision. If your dining room chairs are stained or outdated, you may want to recover them or use slipcovers. In most cases, an imperfect table can be camouflaged with a neutral and stylish tablecloth.

Be sure the table is centered underneath the chandelier and on the area rug if you’re using one. If your dining room is small, remove all other furniture and leave only four chairs.8

Dress up the table using nice tableware and cloth napkins or a table runner and centerpiece. For a long table, try lining up a series of small vessels down the middle.

Start in your living room and think about what you want to emphasize (and de-emphasize) about the space. For example, do you have a beautiful fireplace or a stunning view? If so, arrange the furniture with that focal point in mind. Use a symmetrical seating arrangement to create a cozy conversation area adjacent to the focal point.

If the room is small, consider removing some of the furniture to make it feel larger, especially oversized pieces. That includes oversized television sets, unless it’s a designated media room. Pulling furniture away from the wall can make the room feel more spacious, and placing your largest furniture piece in the far-left corner (as opposed to near the entry) can create the illusion of a larger space.9

For small bedrooms, remove all the furniture except the bed, bedside tables and a dresser. If it’s a large room, add one or two chairs and a table to create a seating area. Place lamps on the bedside tables and seating area if you have one.10

Make sure each space in your home has a clearly defined purpose. For example, if you’ve been using an extra bedroom as a catch-all storage space, stage it as a guest room or office instead. Turn an awkward alcove into a workstation or a reading corner. Help buyers imagine how they could use the space themselves.3

Lighting can have a drastic impact on the look and feel of a home. Few buyers seek out a dark house; most prefer one that’s light and bright. Make sure windows are clean, and open curtains and blinds to let in the maximum amount of daylight.

Each room should have three types of lighting: ambient (general or overhead), task (such as a reading lamp or under-cabinet light), and accent (such as a floor or table lamp). Aim for a goal of 100 total watts per 50 square feet.11 If your mounted light fixtures are dated, replacing them with something more modern is an easy and inexpensive upgrade that can have a big impact.

Strategically placed landscape lighting can add a dramatic effect to your home’s exterior. Welcome evening visitors with a lighted walkway, or use a spotlight to accentuate trees or other landscaping features. Solar lights require no wiring; simply place them in a sunny spot and they will turn on automatically at dusk.

While your home’s interior often takes center stage, don’t forget about staging your home’s outdoor areas to help buyers imagine how they could utilize the space.

Even a small patio can become a selling feature with the addition of a cafe table and chairs. Add a tray of plates and coffee cups to help buyers envision a peaceful breakfast on the back porch. Place chairs and wine glasses around an outdoor firepit or hang a hammock with a book in your favorite shady spot.3 These small, simple additions can help buyers visualize the possibilities your backyard has to offer.

BEFORE YOU GET STARTED

If you’re in the market to sell your home, this list provides a great starting point for your preparations. But nothing beats the trained eye and expertise of a real estate agent. Before you do any work, we recommend consulting a professional for advice about your particular property.

We offer free, no-commitment seller consultations and will walk through your home with you to help you assess which projects and upgrades are worth your time and money, and which ones you can skip.

As local market experts, we are intimately familiar with buyer preferences in your area. We’ll run a comparative market analysis to find out how your home compares to others currently on the market, as well as those that have recently sold. Then we’ll tailor a custom plan to suit your particular property, budget and needs.

For more information, visit our page on Facebook, https://www.facebook.com/HeernProperties. Please call or email us today with questions or to schedule a free consultation!

###

Sources:

We frequently get questions from clients who are taking on decorating and remodeling projects and want to ensure their dollars are invested wisely.

Which looks will last for years to come, and which ones will feel dated quickly? What colors and styles are most popular among buyers in our area? How can I add the most value to my home?

So, we’ve rounded up some of the hottest tips in home design to help guide you through the process. Whether you’ve planned a simple refresh or a full-scale renovation, making smart and informed design choices will help you maximize your return on investment and minimize the chance of “remodeler’s remorse” down the road.

Today’s designs are more into the warmer and cozier elements throughout the home.

A cool color scheme has dominated home design in recent years, but it has now shifted to warm neutrals like brown and tan are back, along with rich jewel tones. While the pastel craze of last year is still hanging on, expect to see alternative color palettes featuring deep, saturated shades of red, yellow, green and navy. Grey will remain popular, but in warmer tones, often referred to as “greige.”

Along with warmer colors, there is now a shift from stark, modern design to cozier looks. Velvet upholstery, woven textures and natural elements, like wood and stone, are heating things up these days.

It used to be considered gauche to mix finishes, however the look of mixed metals is now very big. Brass continues to trend, along with matte black and classics like polished chrome and brushed nickel.

What’s also trending now are the bright, bold patterns in the form of geometric shapes and graphic floral prints. These are featured on everything from furniture to throw pillows to tile.

Look for the use of natural elements throughout the home, including wood, stone, plants, flowers and grass. Botanical patterns seen in prints, wallpaper and upholstery are also trendy. Try to also add some concrete accents to complement these additions in an effort to bring the essence of the outdoors inside the home.

Also called an accent wall, a feature wall is one that exhibits a different color or design than the other walls in the room. It can be seen now that there is an increased use of feature walls showcasing rich paint colors, bold patterned wallpaper, and textures brought in through millwork and shiplap.

Lighting is taking center stage with distinctive fixtures, including local artisan and vintage pendants and chandeliers. And smart lighting technology are enabling homeowners to customize their lighting experience based on time of day, activity, and mood.

Hardwood floors continue to dominate the market. The trend is toward either very dark stains paired with light-colored walls or light stains with darker walls. Greyish tones will remain popular, as will matte finishes, which are easier to maintain than high gloss. Expect to see frequent use of wider and longer wood planks, as well as distressed and wire-brushed finishes, which add texture and dimension.

Everything is getting “smarter” in homes, from locks and lights to thermostats and appliances. And with devices like Google Home and Amazon Alexa, you can control many of these with voice activation from a central hub. We are seeing a continued integration of and advancements in smart-home technology.

OUR ADVICE

Style trends come and go, so don’t invest in the latest look unless you love it. That said, highly-personalized or outdated style choices can limit the appeal of your property for resale.

For major renovation projects, it’s always a good idea to stick to neutral colors and classic styles. It will give your remodel longevity and appeal to the greatest number of buyers when it comes time to sell. It will also give you flexibility to update your look in a few years without a total overhaul. Use non-permanent fixtures – like paint, furniture and accent pieces – to personalize the space and incorporate trendier choices.

If you’d like advice on a specific remodeling or design project, give us a call! We’re happy to offer our insights and suggestions on how to maximize your return on investment and recommend local shops and service providers who may be able to assist you.

Great 2 story in St Peters waiting for your family to call it home. In the desirable Highlands subdivision. Walk in to a spacious floor plan with hardwood floors. Newer lighting throughout and freshly painted in contemporary gray tones. The large kitchen has a beautiful new granite counter, lots of cabinets and other updates in the kitchen. The kitchen opens to the family room and living room with a wood burning fireplace which makes for those great times for entertaining or relaxing together. Dining room with hardwood, main floor laundry room and half bath complete the space. Upstairs you have 4 nice sized bedrooms, and two full baths. Also, hardwood flooring in 2 of the bedrooms and new carpeting in one room, French doors to master bedroom with luxury master bath. Full basement waiting for your ideas. Then there’s a great back yard with wood fencing, patio and a beautiful retaining wall all in St Peters, near Whitmoor. Asking $269,900.

Great 2 story in St Peters waiting for your family to call it home. In the desirable Highlands subdivision. Walk in to a spacious floor plan with hardwood floors. Newer lighting throughout and freshly painted in contemporary gray tones. The large kitchen has a beautiful new granite counter, lots of cabinets and other updates in the kitchen. The kitchen opens to the family room and living room with a wood burning fireplace which makes for those great times for entertaining or relaxing together. Dining room with hardwood, main floor laundry room and half bath complete the space. Upstairs you have 4 nice sized bedrooms, and two full baths. Also, hardwood flooring in 2 of the bedrooms and new carpeting in one room, French doors to master bedroom with luxury master bath. Full basement waiting for your ideas. Then there’s a great back yard with wood fencing, patio and a beautiful retaining wall all in St Peters, near Whitmoor. Asking $269,900.

You won’t want to miss this charming 2 Story in desirable Fox Pointe Subdivision in Fox C6 School district. Open to the Family Room with lots of windows, Bay Windows. 4 Bedrooms 3 Full Baths, fenced yard.

Newer lighting throughout and freshly painted in contemporary gray tones. New Stainless appliances, lots of cabinets and other updates in the kitchen. A large family room with a bay window & wood burning fireplace makes for those relaxing times together. Main floor laundry room & full bath on the main level are great finishing touches.

Upstairs you have 4 nice sized bedrooms, and two baths. Newer flooring in Master Bedroom, Master Bath & Hall Bath as well as the Laundry Room & First Floor bath. Full basement waiting for your ideas. (There is a room that has been built with electric could be used for an office). Then there’s a great back yard with white vinyl fence, patio and a beautiful retaining wall all in Arnold MO. Asking $219,900.

Beautiful 2 Story in Arnold

Beautiful 2 Story in Arnold

Beautiful 2 Story in Arnold

Beautiful 2 Story in Arnold

Beautiful 2 Story in Arnold

Beautiful 2 Story in Arnold

Beautiful 2 Story in Arnold

Beautiful 2 Story in Arnold

2846 Raritan Dr in Rock Hill MO, is an amazing home for the money.

Wow! You will be captivated by the elegant details of this “like new” home. You will be blown away by the impeccable detail from top to bottom. You won’t find anything to compare with this home in its price range. Walls have been opened up and the stairway with custom designed balusters. Hardwood floors throughout have been completely refinished, as well as completely new lighting.

Updated kitchen with high end ‘soft close’ cabinetry is a delight with granite counters and all new stainless appliances, including a stainless fridge. Then there is the pantry for extra storage.

There’s more to see…. The coffee/wine bar just off of the dining room with open shelving. Then check out the new bath with impeccable finish with the luxurious tile work, that looks like a waterfall. Also off of the bedroom on the main floor is a wonderful escape room…. An enclosed sunroom to have your morning coffee or just to get away, overlooking the large yard.

Up on the second floor you’ll find 2 bedrooms a larger one that could also be a master and a smaller one that would be great for a child or an office with a window seat, a half bath and a walk-in closet. Make sure to take a look at the beautiful grain of the pine floors.

This house is like new; New roof, new windows, new siding, new plumbing, new HVAC & ductwork, and updates to the electric.

Then the basement, with 10 foot ceilings and a walkout!! There is no finish but it is cleaned & painted ready for whatever you want. The backyard is huge for this area & backs to common ground, it’s freshly cleared.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

Coffee/Wine Bar with open shelving

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

‘Like New’ Craftsman 1 1/2 Story in Rock Hill MO, for sale.

Wow! is all I can say when I was captivated by the elegance of this home when I saw the finish of this complete remodel. You will be blown away by the impeccable detail from top to bottom. You won’t find anything to compare with this home in it’s price range. The openness with the soaring vaulted ceiling with it’s beautiful wood beam and recessed lighting. To the beautiful fireplace with gas starter in what I truly call a GREAT Room. All of this with textured bamboo wood throughout.

The upgraded kitchen is a delight with an abundance of cabinets and counter space galore. Talk about entertaining. This is it! Granite counters and stainless appliances including a stainless refrigerator. The large island with space for additional seating.

Then there’s more…. Spotless details throughout. Beautiful high-quality finishes in all three bathrooms with luxurious tilework, new cabinets, lighting and fixtures, remodeled to perfection. There are also skylights, new 6 panel doors, lights in the closet and an attic fan. Did I mention completely new lighting throughout? If that’s not enough, there are two (2) Master Bedrooms with on suite baths. The lower level is remodeled as well with laminate and recessed lighting. In the backyard you can continue your entertaining with a huge deck with new cedar railing and on the patio. We also need to mention the mud room just off the garage. There is also a new French drain around the exterior back. The exterior has been updated with cedar craftsman accents, as well as the new landscaping in the front entrance. The summer time will be so enjoyable with access to the inground pool just for your subdivision.

Come and see for yourself at our Open House on Saturday 12/9/17 from 1-3. Listed at $249,900.

Remodeled Open Vaulted Ranch with 2 Master Bedrooms

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Beautiful 2 Story ready to move into in Arnold MO

Gorgeous 2 story waiting for your family to call it home. Newer flooring in living room, dining room, kitchen and breakfast rooms. Stainless appliances, lots of cabinets and other updates in the kitchen. Half bath on the first floor. Upstairs you have 3 nice sized bedrooms, two baths both updated. Also finished walk out lower level with a family room and half bath. Then there’s a great back yard with a huge deck with a patio below. All of this in desirable neighborhood in Arnold MO. Asking $164,900. Coming Soon